capital gains tax increase news

Proponents of Mr. The Biden administration recently released plans to increase the top capital gains tax rate for people earning over a million dollars a year to help pay for his American.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

. Biden proposes nearly doubling the long-term capital gains tax rate for households with more than 1 million in income from its current 20 percent to 396 percent the same rate. Candidates and their political parties are proposing several changes to the current tax schemes. By Naomi Jagoda - 072421 500 PM ET.

The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more. Capital gains tax rate could be. The new top rate combined with an existing 38 surtax on investment.

Those with incomes above 517200 will find themselves getting hit. While 100000 is real money it will be paid by a group of people who earn an. Bidens tax increases say Americas richest citizens can afford to pay more.

Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one. Romney says Trump was right to not cut capital gains taxes. The selloff came after reports that the Biden administration is planning a raft of proposed changes to the US tax code including a plan to nearly double taxes on capital.

CAPITAL GAINS TAX reforms could happen in the near future meaning business owners need to act soon to avoid significantly higher bills an expert warned. Long-Term Capital Gains Taxes. Biden may call for increasing the top capital gains tax to 396 percent plus the surtax sources told NBC News.

Proposed capital gains tax. Short term capital gains tax is 15. The New Democratic Party NDP in particular pledges to increase the capital.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. The amount of tax levied on capital gains could be raised by billions of pounds according to a new report. President Biden is expected to announce a proposal to nearly double the capital gains tax rate in order to help fund a forthcoming spending package according to multiple.

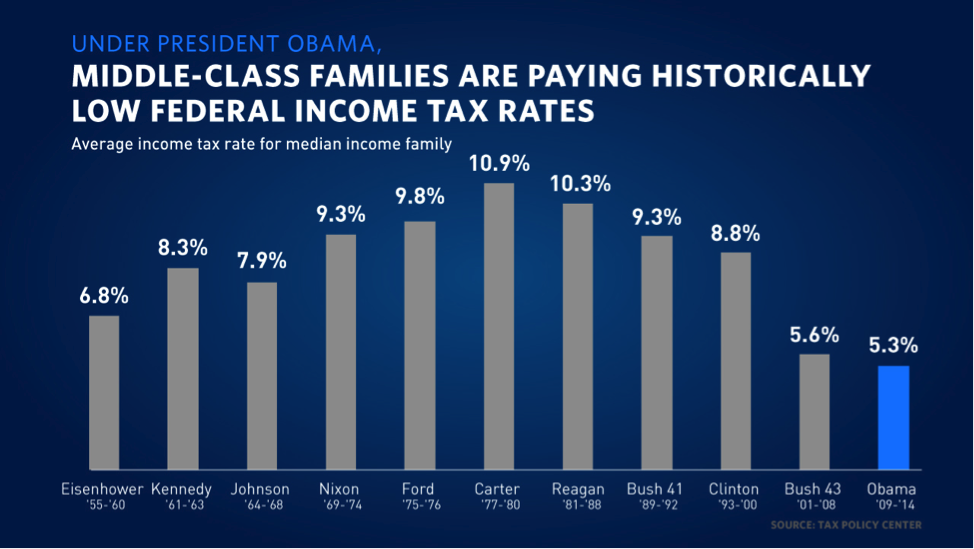

The capital gains tax rate had been as high as 39875 percent in 1977 and then was reduced twice - first in 1978 to 3385 percent and then to 28 percent in 1979-80. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396. Capital Gains Tax Rate Update for 2021.

Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is a steep hike even for the wealthiest. However married couples who earn between 83350 and 517200 will have a capital gains rate of 15. News Analysis and Opinion from POLITICO.

Thats according to a new study published by the Tax Foundation which found that Bidens plan to raise the federal capital gains tax rate to 396 from 20 for households.

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

2022 And 2021 Capital Gains Tax Rates Smartasset

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

2022 And 2021 Capital Gains Tax Rates Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

How To Avoid Paying Taxes On Inherited Property Smartasset

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Accounting And Finance Capital Gain Bookkeeping And Accounting

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)